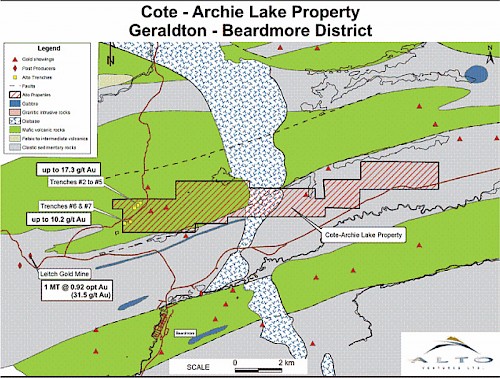

Alto Ventures (TSX.V:ATV) is pleased to announce that it has reached an agreement to acquire the Cote - Archie Lake gold property located east of the historic Leitch mine in the Beardmore-Geraldton gold district, Ontario. The district produced in excess of four million ounces gold, during a thirty-five year operating period extending through the late 1960's, from high grade, shear-hosted quartz vein systems and lower grade deposits related to banded iron formations. Leitch was one of the premier high grade mines of the camp and produced 860,000 ounces gold at an average grade of 0.92 ounces per ton (31.5 grams per tonne) gold before closure in 1968.

The Cote Archie Lake property consists of 18 claims totaling 2,352 hectares and covers 12 kilometres of prospective ground east of, and along strike from, the productive vein system developed in the Leitch mine.

Initial exploration on the property, involving prospecting, trenching, and preliminary sampling, has resulted in the identification of two gold occurrences including an east-northeast trending shear zone, up to 12 metres wide, believed to represent the strike projection of the structure hosting the Leitch veins approximately 5 kilometres to the west. The zone has been exposed in two trenches, 200 metres apart, with quartz and quartz-carbonate-sulphide veins from which grab samples contain up to 10.2 grams per tonne gold. The original Cote gold showing, located 600 metres to the north, has reported gold mineralization of up to 0.79 ounces per ton (27 grams per tonne) gold. Further trenching by Alto in this vicinity has traced a series of shear hosted quartz veins in a north-northwest trending direction. Initial grab samples from veins in these trenches contain gold mineralization up to 17.3 grams per tonne gold.

More detailed prospecting, trenching, and systematic channel sampling for definition of drill targets will be carried out in both areas during the 2005 summer program.

Under the agreement, Alto can acquire a 100% interest in the Cote-Archie Lake property. Alto has paid $20,000 and will issue 50,000 shares and make further cash payments of $10,000, and issuances of 50,000 Alto shares, on each of the first and second anniversary dates of the agreement. The vendors will retain a 2% net smelter return royalty (NSR) and Alto has the right to buyback half of the NSR for $1,000,000.

Quality Control

All gold assays were performed at TSL Laboratories in Saskatoon. Initial assays were performed by standard fire assay/gravimetric finish methods using a one assay-ton charge from a 250 gram split that was pulverized to -150 mesh. By request, samples with values exceeding one gram/tonne were re-assayed from another split of the reject to confirm the quantity of gold in the sample. Internal check and standards assays were also performed by the laboratory. The assays presented represent the average of all assays performed on the specific sample. Mike Koziol, P.Geo., P.Eng, Alto's Vice President of Exploration was the qualified person supervising the field program.

About Alto Ventures Ltd.

Alto is a gold exploration and development company with an exceptional portfolio of properties in the Canadian Shield. The Company is focused on exploration and acquisition of mineral properties in the Abitibi greenstone belt in Ontario and Quebec as well as properties in the western Superior Province of Ontario and Manitoba.

ON BEHALF OF THE BOARD:

Rick Mazur

President & CEO

The TSX Venture Exchange has neither approved nor disapproved of the contents of this press release.

For further information, contact:

Rick Mazur

President & CEO

Alto Ventures Ltd.

Suite 910-475 Howe Street

Vancouver, B.C. V6C 2B3

Phone: 604-681-2409

Fax: 604-689-3609

Email: info@altoventures.com