- Significant increases in contained ounces for the DAC Deposit, with approximately 364,000 ounces gold "indicated" and approximately 247,000 ounces of gold "inferred"

- All holes from 2010 drilling campaign intersect anomalous gold mineralization

- Four kilometres of strike potential identified by drilling

- Report recommends a $4M expansion drilling program

March 7, 2011, Vancouver, BC - Alto Ventures Ltd. ("ATV") TSX-V: ATV and Pacific North West Capital Corp. ("PFN") TSX: PFN; OTCBB: PAWEF; Frankfurt: P7J (together "the Companies") are pleased to announce the filing on Sedar of an NI43-101 Technical Report (the Report), including a new Mineral Resource Estimate for the DAC Gold Deposit, on the Destiny Project located near Val d'Or, Quebec. The Companies have also received final assay data for the 3-hole exploratory drill program conducted in late 2010 and provide an update on future plans to expand the mineral resource at the Destiny Gold Project.

NI43-101 Mineral Resource Estimate Report

The Mineral Resource Estimate was initially reported in news releases from the Companies on January 24, 2011. The Report was prepared by Wardrop, a Tetra Tech Company (Wardrop) and incorporates over 7,600 m of additional drilling that was completed on the deposit subsequent to an earlier NI43-101 compliant resource estimate calculated by W. A. Hubacheck Consultants Ltd and filed on SEDAR in 2007. The Wardrop report indicates that the additional drilling has expanded the DAC Deposit and significantly increased the contained ounces of gold over that which was reported in 2007.

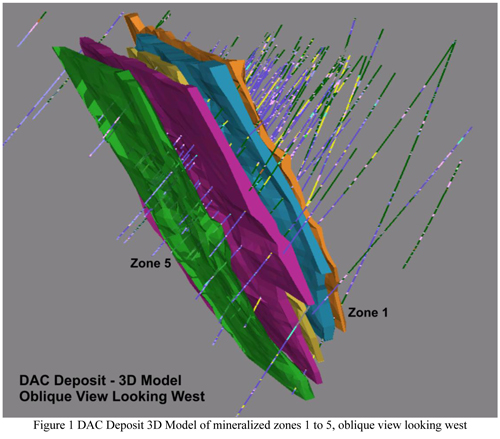

At a cut-off grade of 0.5 g/t gold and using the Inverse Distance Squared (ID2) estimation method, the five gold zones that make up the DAC Deposit contain an Indicated Resource of approximately 10.8 million tonnes with an average grade of 1.05 g/t gold (364,000 contained ounces). In addition, the Inferred Resource totals approximately 8.3 million tonnes with an average grade of 0.92 g/t gold (247,000 contained ounces). The resources block considers the mineralization to start at approximately 15 m below surface down to a depth of 400m for the deepest zone (see Figure 1). The mineralization remains open below 400 m. For details regarding the resource estimate methods and calculation parameters used in preparation of the Report please see the news releases issued from the Companies on January 24, 2011.

Mineral Resources are not Mineral Reserves and by definition do not demonstrate economic viability.

2010 Drilling Results

Results from the three-hole diamond drilling program completed on the Destiny property in December were received. Each of the three drill holes (DES10-139, 140 and DES08-113X) had a specific objective with respect to defining controls on the mineralization at the Destiny Gold Project. These are summarized as (1) to test selected Borehole Electromagnetic (BHEM) conductors and assess the association of areas of sulphide mineralization with gold mineralization, and (2) to test for shallow gold mineralization to the south of the DAC deposit where the recently completed high resolution magnetic survey identified magnetic signatures similar to DAC (see news release dated December 16, 2010).

Previous drilling revealed massive sulphide mineralized lenses locally adjacent to the gold mineralization (see NR dated April 12, 2010). The Companies interpreted these sulphide lenses as important to the gold mineralizing system and completed BHEM surveys in certain drill holes to trace the extent of the massive sulphide mineralization and to help guide drilling at depth.

Drill hole DES10-139 tested an off-hole conductor near the west end of the DAC Deposit. The hole was also drilled deeper to fully intersect the five DAC gold zones. Three lenses of massive sulphides were intersected from 360 m to 374 m downhole. The lenses vary in width from one metre to 3.2 m and are made up of mainly pyrrhotite and pyrite and carry anomalous amounts of base metals confirming that the BHEM method is effective at targeting the massive sulphide mineralization. The hole also intersected anomalous amounts of gold at the western end of the DAC gold zones. These results confirm that the wide envelope of anomalous gold mineralization at the DAC deposit persists (Table 1).

DES10-140 tested the geology south of the DAC Deposit. This hole cut several areas of shearing, alteration and weakly anomalous gold mineralization. The hole returned one assay of 3.45 g/t across 0.3 m (see Table 1) indicating the prospectivity for more gold mineralization at shallow depths across strike, making for a potentially thicker deposit.

At the Zone 20 target area, more than 3 km east of the DAC deposit, drill hole DES08-113X was deepened from 200 m to 550 m to test an off-hole BHEM conductor and test Zone 20 at greater depths. The conductor is explained by narrow veins of pyrrhotite and pyrite mineralization. Anomalous gold coincident with Zone 20 was intersected from 468.7 m to 488 m (see Table 2). The results from this hole confirm that the gold system associated with the Despinassy Shear is extensive along strike extending from the west of the DAC Deposit for four kilometres to Zone 20. The gold mineralization also persists at depth both at the DAC Deposit to below 600m and Zone 20 to below 400m.

| Hole Name |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

| DES10-139 | 377.95 414.8 450.0 518.75 |

406.25 437.8 453.7 527.05 |

28.3 23.0 3.7 8.3 |

0.35 0.24 0.53 0.34 |

| DES10-140 | 118.05 | 118.35 | 0.3 | 3.45 |

| DES08-113X | 380.4 468.7 477.9 |

381.5 470.95 488.0 |

0.95 2.25 10.1 |

3.15 1.01 0.34 |

Table 1 Gold Mineralized Intervals from the 2010 - 3 hole exploratory drill program*

*Based on core angles and previous drilling, true widths are estimated at approximately 80 to 90% of the downhole lengths reported. Mineralized zones generally start at 0.1 g/t gold and assay averages may include minimal intervals of waste material. No top cuts of assays were used.

Summary and Future Plans

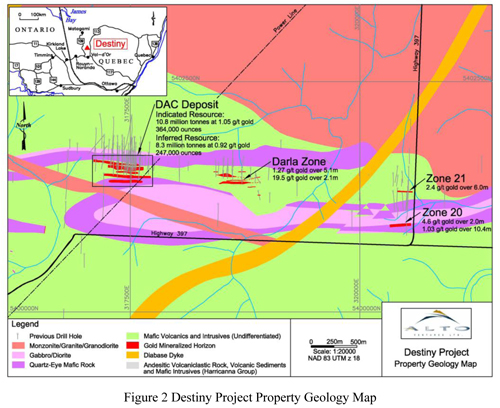

The NI 43-101 resource estimate indicates that the gold zones start near surface and are considered by the Companies to be amenable to an open pit mining scenario. The DAC Deposit remains open along strike and to depth and is one of several significant gold occurrences along a four kilometre segment of the Despinassy Shear Zone. The gold mineralization at the other occurrences also starts near surface, and with additional drilling these other occurrences may add significantly to the contained ounces on the property either as satellite zones to the DAC or as new deposits (see Figure 2).

Results reported to date from the Destiny Project are very positive. The recent drill program has confirmed anomalous gold values across strike and give rise to the possibility that additional shallow mineralization may be added to the currently defined resource through continued exploration. The Companies believe that there is excellent potential to significantly increase the contained ounces on the property.

A four million dollar exploration and expansion program was recommended in the report by Wardrop. Major exploration programs for later this year are in the planning stages. The programs will consist of surface geochemical surveys over the Despinassy Shear, to help locate specific drill targets, followed by diamond drilling. The drilling is intended to target additional shallow gold mineralization to increase the viability of an open pit mining scenario for the project.

Qualified Persons

Todd McCracken, P.Geo, is a Qualified Person ("QP") for purposes of NI 43-101 Report. He is responsible for preparing the Report and the Resource Estimate disclosed in the Report. Mr McCracken is an employee of Wardrop, and independent from the Companies as described in section 1.4 of NI 43-101. He has read and approved the technical disclosure in this press release pertaining to the Report.

Mike Koziol, P. Geo., P.Eng. is the Qualified Person who has reviewed and approved the other technical content in this news release.

About the Destiny Property

The Destiny Project is under option with Pacific North West Capital. Under the terms of the option agreement, PFN can earn a 60% interest in the property over a four year period by completing $3.5 million in exploration expenditures, paying $200,000 and providing a total of 250,000 PFN shares to Alto. The property consists of 177 claims totalling 7,421 ha and is located approximately 100 km by road north of the city of Val-d'Or. The property is accessible by provincial highway 397 which passes through the property.

Pacific North West Capital has fulfilled its obligations for the first two years of the option term as outlined in the agreement.

About Pacific North West Capital Corp

Pacific North West Capital Corp. is a mineral exploration company focused on Platinum Group Metals (PGM), precious and base metals. Management's corporate philosophy is to be a project generator, explorer and project operator with the objective of option/joint venturing projects with major and junior mining companies through to production. To that end, Pacific North West Capital's current option/joint ventures agreements are with Anglo Platinum, First Nickel, Alto Ventures. In addition, Pacific North West Capital is a major shareholder of Fire River Gold Corp. (www.firerivergold.com)

Pacific North West Capital Corp. is a member of the International Metals Group of Companies. www.internationalmetalsgroup.com

About Alto Ventures Ltd

Alto Ventures Ltd. is an exploration and development company with a portfolio of highly prospective Canadian gold properties. The Company is active in Quebec in the Abitibi greenstone belt where it has a number of projects including the Alcudia and Destiny gold properties. In Ontario, the Company is exploring in the Beardmore-Geraldton gold belt and the Coldstream project in the Shebandowan gold district. In the Chilcotin Plateau of British Columbia, the Company is exploring the Chilko project nearby the Newton gold deposit. For more details regarding the Company's projects, please visit our website at www.altoventures.com.

ON BEHALF OF THE BOARD,

Richard J. Mazur, P. Geo.,

CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact:

Mike Koziol,

President and Director

ALTO VENTURES LTD.

Unit 8 - 1351D Kelly Lake Rd

Sudbury, ON., P3E 5P5

Tel: 705-522-6372

Fax: 705-522-8856

Email: koziol@altoventures.com

Website: www.altoventures.com

Rick Mazur,

CEO & Director

ALTO VENTURES LTD.

910-475 Howe Street

Vancouver, BC, V6C 2B3

Tel: 604-689-2599

Fax: 604-689-3609

Email: info@altoventures.com

Website: www.altoventures.com